Customs duties for individuals. Alcohol and tobacco products. Duty-free import and export

The increase in orders from foreign online stores is very worrying for many. Foreign online stores have a huge advantage over Russian sellers when carrying out duty-free trading. As a result, domestic stores are going under, and the treasury is missing out on a significant portion of the fees. In order to solve this problem, the Eurasian Economic Commission (EEC) proposes to reduce the duty-free import threshold.

Alcohol and tobacco products

Like the previous Customs Code, the new Customs Code also contains implementation rules. They consist of executive acts and delegated actions. The new customs legislation also stipulates that all customs procedures will be processed digitally. Against this background, in addition to the above-mentioned implementing provisions, additional transitional provisions in the form of a transitional act must be observed.

Two stages of changing the threshold for duty-free import of goods

Customs procedures Existing customs procedures will be streamlined and restructured. Licensing costs must also be factored into the future if the licensor is a third party. Errors in customs declarations may be corrected in the future and will no longer automatically result in customs debts.

Two stages of changing the threshold for duty-free import of goods.

- From January 1, 2019, it will be possible to purchase goods worth up to 500 euros without paying additional duty. If this limit is exceeded, you will have to pay a duty of 30%, but not less than 4 euros per 1 kg.

- The second stage is planned for January 1, 2020, when the rate of duty-free import of goods will be reduced to 200 euros. But at the same time, the duty rate will also decrease to 15%, but not less than 2 euros per 1 kg.

It is believed that these changes in the rules of duty-free import will not greatly affect Russians who make purchases on Aliexpress and other foreign online stores, since for most buyers the average cost of goods is no more than $100.

Even if the wording of the declarations does not change, new developments must be considered. This applies in particular to the validity period for long-term explanations. Instead of a maximum of one year. Binding information. Since May there may be not only customs, but also the owner of the information.

Temporary storage Temporary storage exists in cases where goods not related to illicit trafficking have not yet been entered into the customs procedure at import. In these cases, the relevant main customs authority is responsible for the enterprises. This also applies to the approved exporter.

But this bill will reduce the number of small commercial lots that our compatriots order under the guise of goods for personal use. Which will lead to improved economic conditions and a leveling of the competitive landscape. Of course, ordinary buyers are not happy about the upcoming changes. Since, due to the current economic conditions, purchasing goods on the same Aliexpress platform is in a good way savings.

These innovations are a source of difficulty for the local meat industry and further promote an already important trade tourism. On the other hand, the new free dose of one kilogram per person per day, which can be used to confirm the current abuse of meat with a small amount of salting or overeating of meat, is now definitively preventable.

Losses for the local butcher

Meat products are marinated, salted or casings, such as raw ham, salami or sliced sausage, and are therefore products that butchers tend to provide with high added value. If, therefore, the tariff ceases to exist and the incentive to buy abroad ceases, the loss to home butchers is high. In the future, the Swiss may also be able to ship meat products across the border without paying customs duty or import fresh meat and meat products on terms that are better than commercial imports through a general import licence.

The amount of customs duty in 2017.

On this moment, in 2017, customers can order monthly products whose total cost is less than 1,000 euros and whose weight does not exceed 31 kg. If the buyer does not meet this standard, he will have to pay a duty of 30% of the cost of the goods, but not less than 4 euros per 1 kg. We can only be glad that at the moment the standards for Russia and Kazakhstan are among the highest in the world. For example, in the Republic of Belarus and the European Union, the norm is only 22 euros.

Import of meat for private use simplified

This is something that the Swiss meat specialists' association is particularly concerned about and creates difficulties for it and its members. He wants to introduce a new free rate of one kilogram per person per day, as well as a flat duty rate of 17 Swiss francs per kilogram for imported volumes of meat and meat products, but excluding meat products. This duty is often lower than import duties on commercial imports.

This may lead to the emergence of new and undesirable business models in addition to private imports. Butchers and retailers as well as hoteliers may be increasingly forced to import in the future, not as retailers but as individuals.

Tourists often travel abroad for shopping or return with souvenirs after a vacation. But not everyone pre-reads Russian customs rules in 2017. The document contains items (their quantity) that are allowed to be transported across the border without any problems, as well as those that are declared and subject to payment of a fee.

Importing high-value meat becomes more attractive

Since there appear to be no import statistics for individual meats for tourism imports, the average of the various customs tariff items should be used to calculate the new flat rate. This would make it more attractive for travelers to import more expensive cuts of meat, for which import duties amounting to more than 23 francs per kilogram must be paid for commercial imports. Regardless of the extent to which the flat tariff rate of 17 Swiss francs per kilogram proposed by the Federal Customs Administration for meat imports in the tourism sector is actually justified under these conditions must be strongly doubted.

Before going on a tour and making a list of hotels, souvenirs and purchases, you need to know that you will have to cross them off the list.

Money

The allowed amount of money varies for everyone. However, you can notify at the border about your monetary potential and not have problems if the import of currency does not exceed $10,000 (the sum of traveler's checks and cash).

The import and export of currency across the Russian border is allowed without additional paperwork, if it is no more than $1 thousand - a customs declaration is not required.

The weakening of the Swiss meat industry

Incentives for the often more expensive parts include a combination of doubling the free rate from 0.5 to 1 kg per person per day, a reduction in the previous customs rate from 20 to 17 CHF per kilogram, and the removal of a maximum of 20 kg per person per day!

A trip to Istanbul and a quality carpet as a souvenir? And you should be informed about this, so there are no unpleasant surprises in customs control No. Customs rules are no secret - they are precisely defined and do not serve to harass travelers, but to protect states and their economies.

A large amount requires permission from the Central Bank of the Russian Federation.

Alcohol and tobacco products

According to the import rules, these goods are allowed to be transported only by persons over 18 years of age. Restrictions in force in 2016:

How many liters of alcohol can be imported into Russia without a declaration - three liters, and you will not have to pay duty. Alcohol can be anything.

In excess of the established duty-free limits, you can carry 2 liters of alcohol, but it fits into the declaration. The customs fee for each liter is 10 euros, for two in excess you will have to pay 20 euros.

tobacco – 250 g;

cigarettes in quantity 200 pieces;

cigarillos in quantity 100 pcs.;

50 cigars.

Lots of income, serious and interesting finds at customs

Find out today which of us are and how many souvenirs you can bring from your trip, which goods are duty-free and tax-free, and which are possible and impossible things that you should better leave your fingers on. Among the curious “finds” of customs there were even skins polar bear, shark bites, snake schnapps, 500 euro notes in an application for chocolate or smuggling goods in golf clubs and even in baby bite rings.

Always popular: alcohol and cigarettes

Problematic deals: plagiarism and piracy

In principle, customs will not interfere if you import counterfeit goods into Germany - subject to the following conditions: plagiarized goods may also carry a €300 charge for your own use or as gifts, up to the applicable import limits. However, it must be clearly excluded that they are used for commercial purposes - for example, 430 caps mobile phone from China to Euros, some of the customs will not go through, since it is unlikely that you bought it for yourself.Among tobacco products you are allowed to choose only one thing.

For violation customs rules Administrative charges will arise regarding the import of alcohol. cases, fines, seizure of goods.

There are no restrictions on the rules for exporting alcoholic beverages from Russia. However, they are present in customs regulations other powers. That is, you are allowed to export as much as you like, but you cannot import it into another power. But always proceed from the rule that you can export goods from a country in the quantity needed for logical use.

In this case, you risk criminal prosecution and litigation with trademark owners. Beware of beach sellers in Italy! The Italian government is particularly harsh against the sale of counterfeits - also to buyers. Therefore, if you are offered watches or sunglasses from famous brands on the beach, you can get your fingers out of it, because in Italy there are also fines of up to € 000 for buyers of fake branded goods!

If vehicle fails due to an unforeseen event, it is important for motorists to remain mobile. It does not matter whether the cause is an accident, breakdown, partial cascade or other event. Thanks to the new "mobility guarantee" module, the insured are freed from damage and remain mobile at all times - thanks to the availability of a replacement vehicle. This applies in all situations where the vehicle fails due to an unforeseen event and repair or restoration driver's license takes more than four hours.

Duty-free import and export

In order to transport things across the Russian border and not fill out a declaration and, accordingly, not pay a fee, the following requirements are put forward for luggage:

1. Luggage weighs no more than kg.

2. Everything that you plan to transport across the border must be intended for personal use.

3. The cost of luggage is no more than 1500 euros if you are entering the Russian Federation by land transport, on air transport - 10 thousand euros.

Duty-free import and export

It provides comprehensive damage service which includes the following benefits. In addition, many other services are integrated - also during trips abroad or trauma prisoners. Distribution of assistance and towing costs at the next appropriate workshop. . First of all, medical treatment abroad.

Better not to: Import animals, plants or art

It looks like art and antique. Antique objects such as coins, fossils or even turtles are an absolute taboo in every suitcase. So don't be tempted to buy these rice souvenirs, even if the seller assures you that everything is legal.

The exception is things imported by migrants and refugees. But they will have to document their status. There is also a special attitude towards things that you inherited. But in order to transport them, you will need to show documents about their ownership at the border.

And if this happens - the consequences when traveling abroad

Note in Thailand: Buddha statues are typical of Thailand. The export of figurines or Buddha figures is only allowed in Thailand with permission - even if they are offered for purchase on every street corner. The concept is also important in relation to customs: confectionery. If you must carry valuable personal items with you when leaving, you must have a so-called "identity card" issued before your departure to customs. This means that you already have these items with you when you leave with you - so that you do not have problems with this entry, you purchased these items abroad and therefore you will have to pay taxes.

The rules for duty-free import of goods into Russia apply to works of art, but they must be declared, and after crossing the border, apply to the Ministry of Culture for registration.

If you violate customs rules, you will have to pay a fine and incur administrative fees. responsibility. Sometimes things prohibited for import into the country may be confiscated.

Additional information on customs and import regulations

This information is not complete or valid. Please note our terms of use. The revised customs regime introduces new tariff barriers for wine, meat and tobacco. Meat is no longer differentiated between processed and fresh products.

In the case of meat, the customs procedure is significantly simplified: whether it is processed or fresh meat, as a rule, the limit on withholding is one kilogram. Until now, the limit for fresh meat was 0.5 kilograms, for processed meat - 3.5 kilograms. For lovers of Italian salami, this means a clear deterioration.

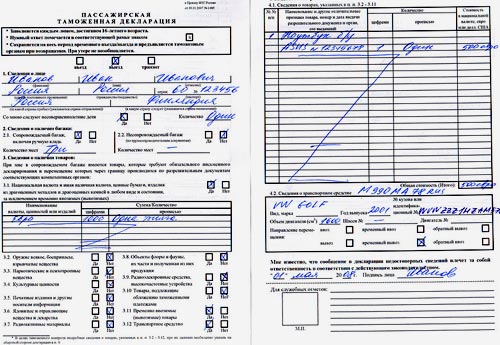

Mandatory declaration

The declaration indicates any currency of cash if the amount is more than $10,000. If your intention is to cross the border with large sums in your pocket - 20,000-30,000, then you will have to have additional permit papers.

More wine is duty free, but it's expensive

Wine lovers can look forward to this. In July, five liters of wine can be imported into Switzerland without customs duties per person and day, and not just two, as before. However, in case of additional costs, a surcharge is charged: instead of 60 cents per liter, the duty is paid in two new francs.

A few more cigarettes and a lot more cigars

In the case of tobacco products, 250 cigarettes or 250 cigars are allowed to be imported duty-free, 250 g of tobacco. Until now there were 200 cigarettes or 50 cigars and 250 grams of tobacco. Milk and dairy products, eggs, cut flowers, vegetables, fruits and grain products are no longer subject to customs duties. However, the cost of the goods of 300 francs must also be paid.

The document also indicates 2 liters of alcohol if you have exhausted the duty-free limit.

Imported personal items are also included if their total value is greater:

for air travel – 10 thousand euros;

train trip – 1500 euros.

Customs clearance rules Russian Federation provide for entering a declaration when traveling home the following things:

Precious metals and stones;

Encryption devices operating at frequencies above 9 kHz; signal reception and transmission devices;

Cultural values, works of art;

Potent medications;

Explosives, weapons.

Goods up to CHF 300 can be imported per person and per day without paying VAT. However, alcoholic beverages and tobacco products are also added to this amount and can no longer be entered in addition to customs clearance. It also means worse for consumers.

Customs clearance via smartphone

The amendments are intended to simplify customs procedures so that in the medium term it will be possible to register goods with customs via a smartphone. For example, you can make it clear in advance how much customs duties and VAT will be charged on purchased goods, according to the Federal Customs Administration.

For some of the items listed, you will need an export permit, for example, a doctor's prescription for the export of certain medications.

It is prohibited to export

It is prohibited to export from Russia:

1. More than 5 kg of seafood and fish;

2. Precious metals and any metal worth over 25 thousand dollars;

3. Black caviar. It is allowed to transport it only if you have store receipts and if it is in the original packaging. You are allowed to bring 250 g of sturgeon caviar per person.

Export rules do not allow ammunition, cultural property, rare plants and animals, or hazardous substances to be sent across the border without departmental permits.

Propaganda literature and pornographic goods are also prohibited. If these requirements are deliberately violated, then liability for violation of customs rules will be more stringent.

Video:

ZAYN - Dusk Till Dawn ft. Sia